There are some exemptions allowed for RPGT. RPGT Exemptions tax relief Good news.

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

This relief is automatic taxpayers do not need to file any additional forms or call the IRS to.

. From January 2016 there is an income tax relief of MYR 25000 per annum for SOCSO contribution. Alex Cheong Pui Yin. Tourism sector tour agencies hotels and airlines relief in the form of revising and deferment of monthly tax installments due between 1 April 2020 and 30 September 2020 with no penalty for tax estimate revision.

Interest on foreign loans. If you owned the property for 12 years youll need to pay an RPGT of 5. The proposed regulations would be exceedingly.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15 2020 are automatically extended until July 15 2020. Theres even a tax relief for alimony payments.

Progressive tax rate and relief. At the end of January 2022 the IRS issued proposed regulations the 2022 proposed regulations regarding the treatment of domestic partnerships and S corporations which own stock in passive foreign investment companies PFICs and their domestic partners and shareholders. The Complete Guide To Personal Income Tax In Malaysia For 2022.

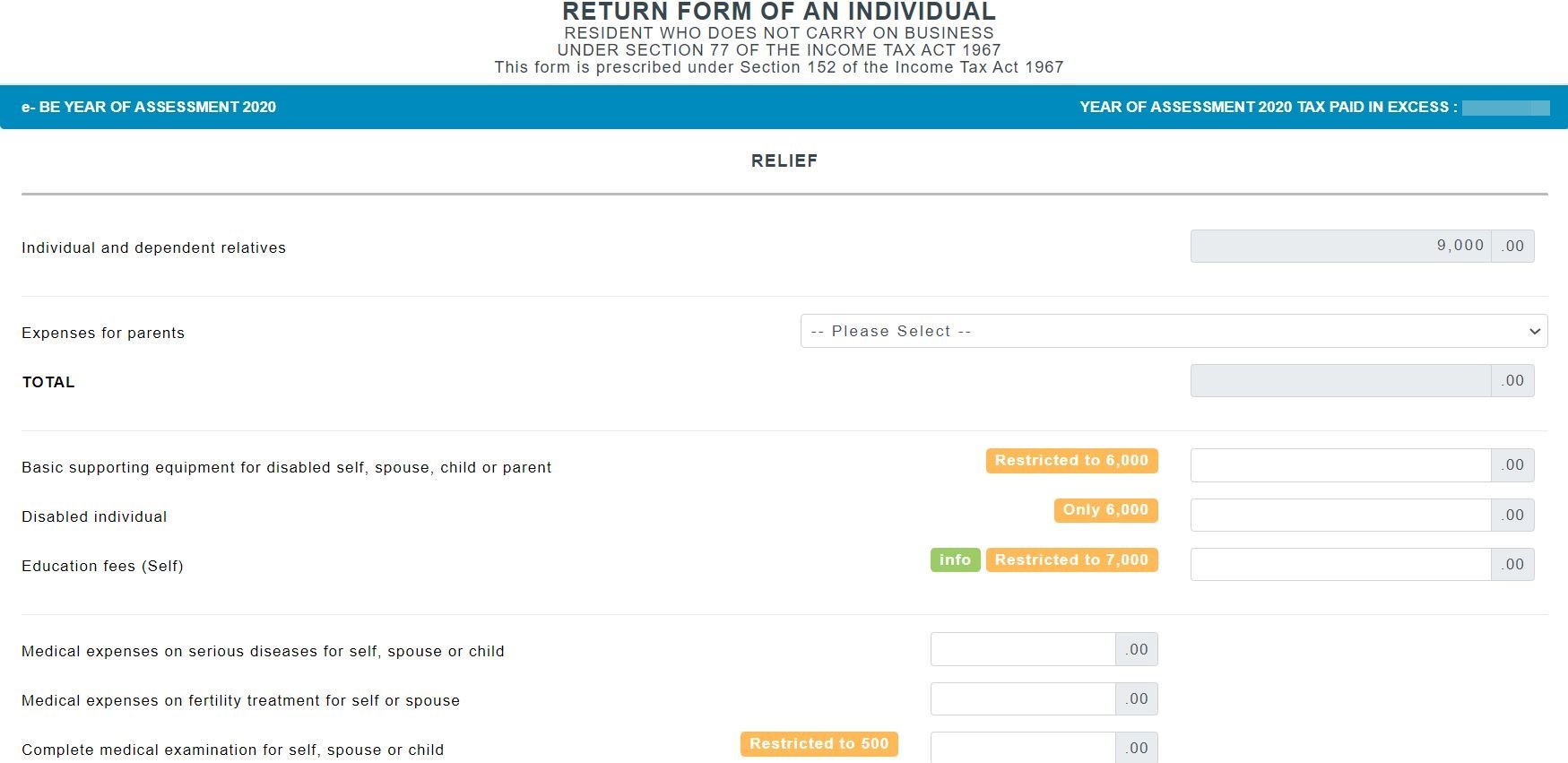

28 from year of assessment 2016 30 from year of assessment 2020 Public Entertainer Interest. A tax relief limited to RM6000 is available for purchases of special support equipment for yourself your spouse children or parents who are disabled. These monthly deductions are net of personal relief relief for spouse with no income child relief EPF relief and zakat payments if any.

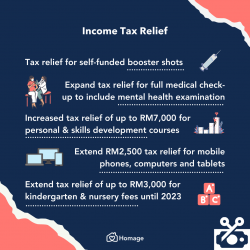

Offer valid for returns filed 512020 - 5312020. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees. For the full list of personal tax reliefs in Malaysia as of the.

The total relief amount was raised by RM2000 from YA 2020s RM6000 in this category. Malaysia Personal Income Tax Guide 2020 YA 2019 Jacie Tan - 1st March 2020. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

Tax rate Income tax in general 25. The tax year in Malaysia runs from 1st January to 31st December. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves. This relief is applicable for Year Assessment 2013 and 2015 only. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550.

Proposed PFIC regulations. This is the income tax guide for the year of assessment 2019. Youll pay the RPTG over the net chargeable gain.

Business trade or profession Employment Dividends Rents. The list of extensions goes on. This relief applies to all individual returns trusts and corporations.

Equipment for disabled self spouse child or parent. Additional RM2500 tax relief for purchases of personal computers laptops smartphones and tablets made between 1 June 2020 until 31 December 2021. 10 beginning 1 July 2020 between the.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. How To File Your Taxes For The First Time. Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 Jacie Tan - 12th March 2021.

Dividends from domestic corporationsif the country in which the foreign corporation is domiciled does not impose income tax on such dividends or allows a tax deemed paid credit of 15or the difference ie. Service Tax exemption for hotels from 1 March 2020 to 31 August 2020. Income Tax in Malaysia.

No cash value and void if transferred or where prohibited.

Income Tax Exemption Malaysia Samirctzx

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax Relief Items For 2020 R Malaysianpf

Deadline To File Income Tax 2019 Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Tax Savings For 2021 Top Tax Reliefs Deductions You Must Not Miss Outefore Year End Yau Co

Prs Personal Tax Relief Dream Supporter Agency

Prs Personal Tax Relief Dream Supporter Agency

Prs Personal Tax Relief Dream Supporter Agency

Should You Invest In Sspn Mypf My

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Deadline To File Income Tax 2019 Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia